During the COVID-19 pandemic, an innovative financing programme is bringing together large corporations, high net worth individuals and retail investors to support small sustainable businesses in Brazil.

Trê – Investing with cause is a young organisation born in Brazil to foster a new economy, contributing to the healthy flow of money towards businesses and entrepreneurs aligned with chosen causes. We structure and operate creative financial solutions, using blended finance mechanisms accessible to both large and small investors, catalysing the role of every donor and investor for the transformation that we want to see in the world. Working for systemic socio-environmental-cultural causes, we operate through financial vehicles, platforms and business models in collaboration with financial institutions, companies, civil society organisations and development agencies.

Our first chosen cause was conscious and sustainable fashion. In Brazil, we have the most extensive fashion production chain in the western world, from the production of natural fibres (Brazil is one of the five largest cotton producers), through spinning, weaving, designing and manufacturing of clothing, all the way up to trade production and large national retail chains. This is an industry, both globally and locally, with complex and conspicuous challenges around issues such as quality of life for workers, waste management, consumer identity and consumption patterns.

In August 2019 we structured our project, aiming to address some of these challenges. Our initial partners included C&A Foundation (now known as Laudes Foundation), which contributed catalytic capital for structuring, as well as the connection with various actors by Lab Moda Sustentável, a project also supported by the foundation. Fundación Avina and Parsifal21 have also been fundamental supporters since the conception of Trê.

We believe in collaborative practice, mobilising and engaging different partners for the success of a project. We encourage the creation of a field of trust in different ways, including art and dialogue spaces for this integration. The development of trust is the basis for the relationships in our team at Tre, and with entrepreneurs, project partners, and with donors and investors.

A philanthropic pool was established as a reserve for future losses – reducing the loss risk for small investors – and potentially for lending with a zero interest rate through the platform

Early in the project, we launched a national call for businesses, in collaboration with accelerators, incubators, individuals and associations in the sector. We received 190 applications, of which 19 companies were selected based on the maturity and positive impact of the business in four dimensions.

In December 2019 we hosted a cultural event to present the first fashion businesses selected to several representatives of the sustainable fashion industry, business development and the impact investment sector.

Our initial expectation was that the 19 chosen companies would undergo a development programme from March 2020, including preparation to access potential investors. When the COVID-19 pandemic hit, some of the selected businesses went into survival mode, with the financial resources to pay their teams becoming a priority over medium-to-long-term development goals. Concomitant to these challenges in the fashion sector, impact businesses from different sectors in Brazil had already anticipated financial challenges as the country emerges from an economic and social crisis.

Faced with these challenges, and relying on our capacity for mobilisation and collaboration, we teamed up with B Corp, the Conscious Capitalism Movement and Din4mo to develop a creative blended finance solution to bring emergency financing to 50 small impact businesses, including some of the fashion businesses that had been pre-selected to receive investments. The CoVida20 project was born with great agility and engagement, for the causes of employment and income.

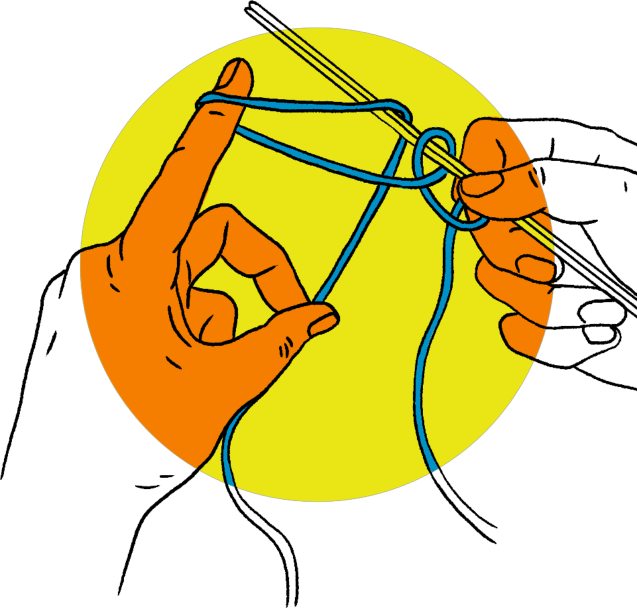

Businesses from all over Brazil have signed up for CoVida20 since April. There are over 280 enrolled to date, following a deep and agile process coordinated by Trê, including interviews, an assessment of the coherence of the impact thesis and an evaluation of creditworthiness based on the viability of the business before the crisis. Trê as a banking correspondent, together with fintech partner Mova, a crowdlending platform authorised by the central bank, developed a financial solution that is simple enough to move at the necessary speed, and able to include investments from hundreds of small investors.

Under this blended solution, selected impact businesses can access long-term loans (up to 48 months), with a grace period up to 12 months and an interest rate of 6.17% per annum , to finance two-to-four months of employee expenses. The average loan per business is close to US$25,000. These conditions are highly favourable compared to commercial bank conditions, when available.

A philanthropic pool was established as a reserve for future losses – reducing the loss risk for small investors – and potentially for lending with a zero interest rate through the platform. Large listed Brazilian corporations such as Gerdau and Magazine Luiza became donors, as did high net worth individuals, with total donations to the pool reaching close to R$800,000 (US$150,000).

Larger investors, including corporations such as Movida as well as high net worth individuals, committed investment amounts from US$15,000 to a range of selected impact businesses through the lending platform, with long lending terms (48 months). Smaller investors can lend from less than US$100 directly to chosen businesses, over shorter periods (24 months).

Sustainable fashion businesses that have already raised loans through the programme include Insecta Shoes (women-led company, based on circular fashion, sustainable design and waste management), MyBasic (women-led company working with sustainable fabrics) and Refazenda (women-led company, based on circular fashion, sustainable design and waste management).

Bringing donors and investors into new blended financing models like the ones Trê is developing in Brazil presents an important education challenge. Foundations and financing civil society organisations (CSOs) are entering an experimental phase regarding catalytic capital allocation for positive impact financial instruments. The usual philanthropic capital goes directly to CSOs working for the UN Sustainable Development Goals, not to financing intermediaries. From the investor perspective, risk and return can be equal or in some cases surpass importance, related to expected positive impact on society and planet. Attracting capital to selected businesses through a peer-to-peer platform can be a challenge when investors are used to a single deposit in mutual funds. A capital market instrument, such as a credit mutual fund or a green bond, would probably make it easier to attract investment capital from multi-family offices and individual investors. We will keep working for a future in which more robust financial structures will deliver clear and fair results for all stakeholders and for the planet.