It was a different time when we conceived of this project in 2019. The climate was already a pressing issue, but most of us weren’t considering the risk of a global pandemic, or parsing the implications for our cultural lives and the livelihoods of the people and organisations who support them. Creativity, Culture & Capital was born out of a shared conviction that arts, culture and creative enterprise are a transformative force for good in the world, and that coordinated collective action by investors, philanthropists and policymakers can turbo-boost this positive impact – in scale, in sustainability and in effectiveness. As creative economies the world over take stock of the post-pandemic landscape, this project has only become more urgent. It is time to examine the financial tools available to us. Using imagination, courage and ingenuity in deploying them, we can ensure that the desire to ‘build back better’ delivers more than an empty catchphrase, cast adrift between the twin supertankers of risk aversion and status quo.

While the creative economy isn’t explicitly recognised in the UN SDGs, as investigated in the British Council’s seminal report, The Missing Pillar, we believe diffuse social benefits are a feature not a bug of our sector. Whether it be grassroots craft organisations delivering jobs, creative clusters driving local economic growth and development, or dance classes addressing loneliness and reducing risk of falls in elderly patients, many arts and creative interventions address more than one of the goals, and this interdependence characterises the power of the arts to address our complex systems and the wicked problems the world is facing today.

Creative approaches are necessary, because siloed disciplines and interventions working along one axis of impact can only address our social challenges in parallel or in series, rather than as a multivariate matrix. And as creatives develop novel initiatives in their attempts to find solutions to these problems, so too must investors be imaginative about how they conceive of and measure impact. Directly measurable positive outcomes work for everyone, but we must remember that not everything good can be measured and not everything that can be measured is good.

Culture and creativity permeate everything we do, and, as Dr Maria Jackson, Chair of the US National Endowment for Arts memorably commented at the Edinburgh International Culture Summit, ‘The arts are often preconditions necessary for so much of what we say we want to achieve in society’. Creative work can provide a much-needed catalyst for significant cultural shifts, whether that be around the devastation climate change is wreaking on the natural world, or on LGBTQ+ acceptance and inclusion.

As impact investors develop their sophistication and deepen their understanding of the social challenges they demand their capital addresses, we believe the creative economy will become increasingly attractive as a home for that capital. It is vital we develop the infrastructure within the creative economy to provide investable opportunities.

The skills we have developed at Arts & Culture Finance in investment origination, impact management, measurement and evaluation, business model understanding, market dynamics, and challenges in areas such as talent development and retention and governance, as well as shortfalls in creating supportive environments for innovation, are specific to the creative economy. We believe our bespoke sector skills and experience not only enable us to build better relationships and promote the potential of impact investment to drive commercial models, economic growth and the myriad other positive impacts of the sector, they also mean we make better investments. We can manage the risk of our individual investments and our overall exposure better, and strike a constructive balance between financial risk and return and impact risk and return. Our position is that local intermediaries with deep knowledge and networks, and strong and proliferating credibility within the target sector, are absolutely vital to driving creative economy growth through impact investment.

There are many exciting opportunities for new fund development. As the energy crisis continues and creative and cultural venues across the world battle with rising costs and outdated energy and heating infrastructure, there is a huge opportunity for impact capital to be deployed to retrofit the sector’s global asset base. Venues are unique in how they seek to engage visitors, and provide not only an opportunity to develop best practice through collective planning and experimentation, but also to ensure that the act of retrofitting is itself an act of public engagement.

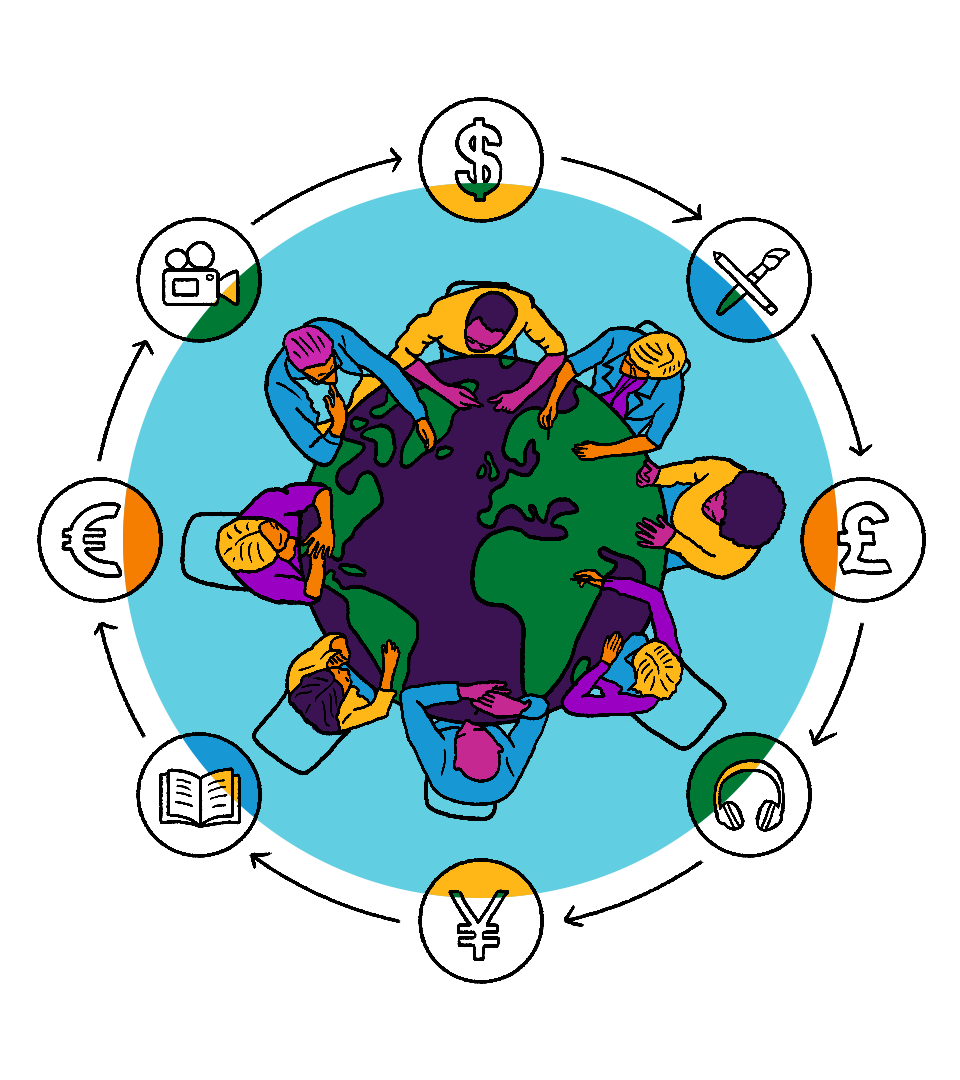

Collective investment vehicles can not only catalyse action by making capital available, they can also be learning centres for what works: we have often helped investee organisations navigate problems we have experienced elsewhere in the portfolio, either by connecting them directly, applying our own learnings across the two situations, or, in some cases, by helping the original organisation productise and sell their valuable experience to willing and grateful customers. The other huge benefits of collective investment vehicles, particularly when investors span the public, private and philanthropic sectors, are that power dynamics shift and diffuse, and, crucially, that the social impact that motivates all of the investors becomes the lodestone around which their otherwise competing agendas can coalesce. When the positive outcome is the ultimate unifying priority, collaboration becomes easier and long-term partnerships are born.

This chapter of Creativity, Culture and Capital is drawing to a close. The beautiful founding coalition of Arts & Culture Finance, Upstart CoLab and Fundacion Compromiso – built on trust, respect and a shared, unswerving belief in the project’s aim of making a compelling case for impact investing in the creative economy – has delivered 100 inspiring stories to ignite a pilot light under this incredible source of positive social outcomes, for individuals, communities, society and the planet.

We know there are more stories out there, and the beginnings of a movement are building. With passion, patience and persistence, we can create a perpetual source of funding for the creative economy that not only values positive impact but insists on it, and a portfolio of vibrant and profitable investment opportunities for impact investors across the globe.